A building recovery is on its way, but housing will fall short of target

Over the five years to FY2029, Oxford Economics Australia forecasts total dwelling completions to total 940,000 – a level 22 per cent below the 1.2 million dwelling National Housing Accord target.

However, from a weakened base, national total building construction is forecast to climb 39 per cent over the four years to FY2029, reaching a record $169.3 billion (constant FY2022 prices).

Western Australia and Queensland are both primed to outperform over the next five years.

Despite renewed government efforts to boost housing supply, it is expected to take until the latter half of the decade before tangible benefits emerge, entrenching affordability as a chronic issue, according to leading independent analyst and industry forecaster, Oxford Economics Australia.

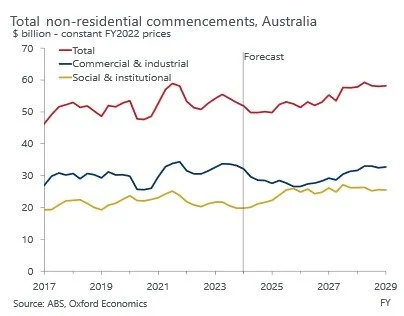

In addition, the company – which is today releasing findings from its flagship Building in Australia report – warns that the non-residential building sector is also expected to continue its slide into next year before a recovery in commencements kicks in from FY2026.

However, Timothy Hibbert, report author and Head of Property & Building Forecasting for Oxford Economics Australia, says it’s not all doom and gloom for the building sector. While FY2025 will remain soft, national total building construction is set to rise from FY2026 and hit a record level of activity by the end of the decade.

“While we will continue to experience a dwelling stock deficiency, activity will inevitably recover in the residential sector. All build forms will contribute, driving total dwelling commencements to a new record level by the end of the decade,” he said. “And a recovery in non-residential is due from 2026, led by hospital asset renewals and a strong pipeline of data centre builds.”

“All told, from a weakened base, national total building construction is forecast to climb 39 per cent over the four years to FY2029, reaching a record $169.3 billion (constant FY2022 prices).”

Housing demand to continue outpacing dwelling completions

The negative pass-through of higher interest rates and strong cost escalation to dwelling construction has almost concluded at the headline level. It is estimated that total dwelling starts will end FY2024 down 10 per cent nationally to a trough of 155,700.

The backlog of work points to home completions holding up over 2024, but strong population growth will continue to power underlying housing demand. Oxford Economics Australia estimates a significant dwelling stock deficiency of 146,000 at June 2024, and expects this will grow further to 164,000 by June 2027.

“A bifurcation has emerged by market,” said Hibbert. “Western Australia is at the front of the pack, with leads for new house demand including land lot sales and lending for new construction well up on a year ago. Queensland is primed as the next to move.”

Improving house construction is set to drive the marginal growth forecast for national total dwelling starts in FY2025 (+2%) to 158,300. While industry capacity is showing signs of improvement in areas, labour shortages remain that will place a speed limit on the early-to-mid stage of the recovery.

Announced policy shifts at both the state and federal level, combined with substantial pent-up housing demand, provide a firm platform for the next upturn. Cash rate cuts are expected from early 2025 – the beginning of a normalisation towards a neutral setting by late 2026.

Attached dwellings are forecast to join the upswing from FY2026 with support from falling interest rates, the upward rebasing of rents, coordinated social housing investment, and planning tweaks in key markets. Build-to-rent development has risen to around one-fifth of apartment starts and is expected to grow this share a little further through late-decade.

Momentum across all build forms is geared to continue over the three years to FY2029, with total commencements rising a cumulative 33 per cent to 241,900 dwellings – a level marginally above the previous record high set in 2016.

However, over the five years to FY2029, Oxford Economics Australia forecasts total dwelling completions to total 940,000 – a level 22 per cent below the 1.2 million dwelling National Housing Accord target. Although some states will likely hit their goals, others will fall short by a meaningful margin.

Non-residential downturn to continue, but expected to recover from FY2026 onwards

A downturn in national non-residential building is showing through with commencements estimated to have ended FY2024 down four per cent to $51.87 billion (constant FY2022 prices).

“The underlying approval lead continues to soften, which is being compounded by a widening gap to commencement,” said Hibbert. “This suggests a higher dropout rate is playing through – a trend likely to persist near term.”

The slide is expected to continue into FY2025, with starts slipping a further four per cent to $49.80 billion. Private investment has slowed, with activity patchy by sector as higher borrowing costs continue to drag in combination with the upwards rebasing of construction costs. As the impact of cash rate cuts and normalising build costs play through, a recovery is forecast to kick in from FY2026, with activity lifting to $58.15 billion in FY2029.

A surge in warehouse construction, underpinned by strong demand, is set to make it the largest sector by commencement value in FY2024.

“While a normalisation is expected through mid-decade, warehouse activity will remain at an historically elevated level – in part supported by higher construction costs with the emerging multi-storey logistics market in Sydney,” said Hibbert.

“Meanwhile, offices and retail have been hampered by a series of structural headwinds. Given growing pockets of oversupply and higher costs, large office developments are becoming increasingly risky without precommitment.”

This is evident in a thin new project pipeline through mid-decade with starts expected to decline a cumulative 41 per cent over the three years to FY2026. Similarly, the prolonged slide in retail building is forecast to continue near term with higher interest rates and pressure on household budgets set to weigh on investment.

Elsewhere on the private capex front, strong growth in data centres has seen other commercial activity pick up steam. A series of very large campus style developments are slated to break ground in coming years, concentrated heavily in Western Sydney.

“Despite delays and uncertainty surrounding state government finances, the public pipeline remains plump, with recent state budgets delivering few surprises,” said Hibbert. “Health building is set to be the standout.”

All major states are working through a period of hospital asset renewal, undertaking very large $500 million+ developments; at the same time population growth is placing pressure on social infrastructure. Towards the end of the decade, Olympic related works will provide a boost to entertainment building in Queensland.

At a state level, the non-residential construction outlooks for New South Wales and Victoria are relatively more challenged over the latter half of the decade, with New South Wales’ share of national activity expected to rebase below pre-pandemic levels. Population growth in the two states is anticipated to run lower relative to the 2015-2019 period, while the next round of public projects is more uncertain in these states.

From a low point in FY2018, Queensland and Western Australia should also see their shares of the national pie continue to lift over the medium to long term as they experience nation-leading population gains. Early indications suggest projects focusing on improving sovereign capacity will also be clustered in these geographies.

About Oxford Economics Australia

Oxford Economics Australia, formerly known as BIS Oxford Economics, is Australia's leading provider of industry research, analysis and forecasting services.

Following the acquisition of BIS Shrapnel in 2017, Oxford Economics Australia now has unparalleled capabilities in helping clients to understand issues across over 100 sectors at the granular local area through to the global economy. This analysis is underpinned through robust economic models that are fed by reliable and most importantly detailed market data, analysis of developments, and thoroughly researched forecasts.

# # #